georgia ad valorem tax 2021

2021 GA SR360 Summary Ad Valorem Tax. The Georgia Department of Revenue assesses all vehicle values for tax purposes each year.

For Georgia car leases the new.

. The tax must be paid at the. Property tax bills shall include the amounts of assessments levied for each of the three immediately preceding tax years. The State Revenue Commissioner is responsible for examining the tax digests of counties in Georgia in order to determine that property is assessed uniformly and equally between and.

Georgia HB997 2021-2022 A BILL to be entitled an Act to amend Part 1 of Article 2 of Chapter 5 of Title 48 of the Official Code of Georgia Annotated relating to property tax. Sales Tax States shows that the lowest tax rate in Georgia is found in Austell and is 4. This calculator can estimate the tax due when you buy a vehicle.

The information on this page is intended to proved some basic information on the treatment of real estate taxes also known as ad valorem taxes in Georgia. New residents to Georgia pay TAVT at a rate of 3 New Georgia Law effective July 1 2019. Instead it appears to be a tax in the nature of a sales.

It is important for property. This tax is based on the cars value and is the amount that can be entered on. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state.

The State of Georgia has an Ad Valorem Tax which is listed on the Motor Vehicle Registration certificate. Georgia Motor Vehicle Ad Valorem Assessment Manual 2 2021 Property Tax Bills Sent Out Cobb County Georgia How Much. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address.

Motor vehicle dealers should collect the state and local title ad valorem tax fee TAVT from customers purchasing vehicles on or after March 1 2013 that will be titled in Georgia. This value is calculated by averaging the current wholesale and retail values of the motor vehicle pursuant to OCGA. Non-titled vehicles and trailers are exempt from TAVT but are subject to annual ad valorem tax.

This tax is based on the value of the vehicle. Accordingly the fair market value for a used motor vehicle for purposes of TAVT will generally be the same as the value that was used in the old annual ad. In the most recent legislative session the Georgia General Assembly passed Senate Bill 65 which made several changes to the title ad valorem tax TAVT code sections.

The links below are reports that show the ad valorem taxes that were levied by local counties schools and cities for the indicated tax year. Local state and federal government websites often end in gov. The tavt rate will be lowered to 66 of the fair.

Other possible tax rates in Georgia include. 20 Annual License Reg. 2021 GA HB352 Summary Ad valorem tax.

A bill to be entitled an act. The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. 2021 property tax bills 2021 property tax bills for the city of jasper will be mailed on friday november 12 2021.

Ad valorem tax more commonly known as property tax is a large source of revenue for. The Georgia Annual Ad Valorem Tax applies to most vehicles purchased prior to March 1 2013 and non-titled vehicles and qualifies as a Personal Property Tax. March 17 2021 513 PM.

The Georgia Annual Ad Valorem Tax applies to most vehicles purchased prior to March 1 2013 and non-titled vehicles and qualifies as a Personal. Local state and federal government websites often end in gov. Use Ad Valorem Tax Calculator.

Assessments are by law based upon 40 of the fair market value for your vehicle. The property taxes levied means the taxes. The new Georgia Title Ad Valorem Tax TAVT is not deductible as a property tax as it is not imposed on an annual basis.

Georgia HB498 2021-2022 A BILL to be entitled an Act to amend Part 1 of Article 2 of Chapter 5 of Title 48 of the Official Code of Georgia Annotated relating to property tax. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. If the vehicle is currently in the TAVT system the family.

Cost and Fees Distribution. A BILL to be entitled an Act to amend Part 1 of Article 2 of Chapter 5 of Title 48 of the Official Code of Georgia Annotated relating to property tax exemptions so as to.

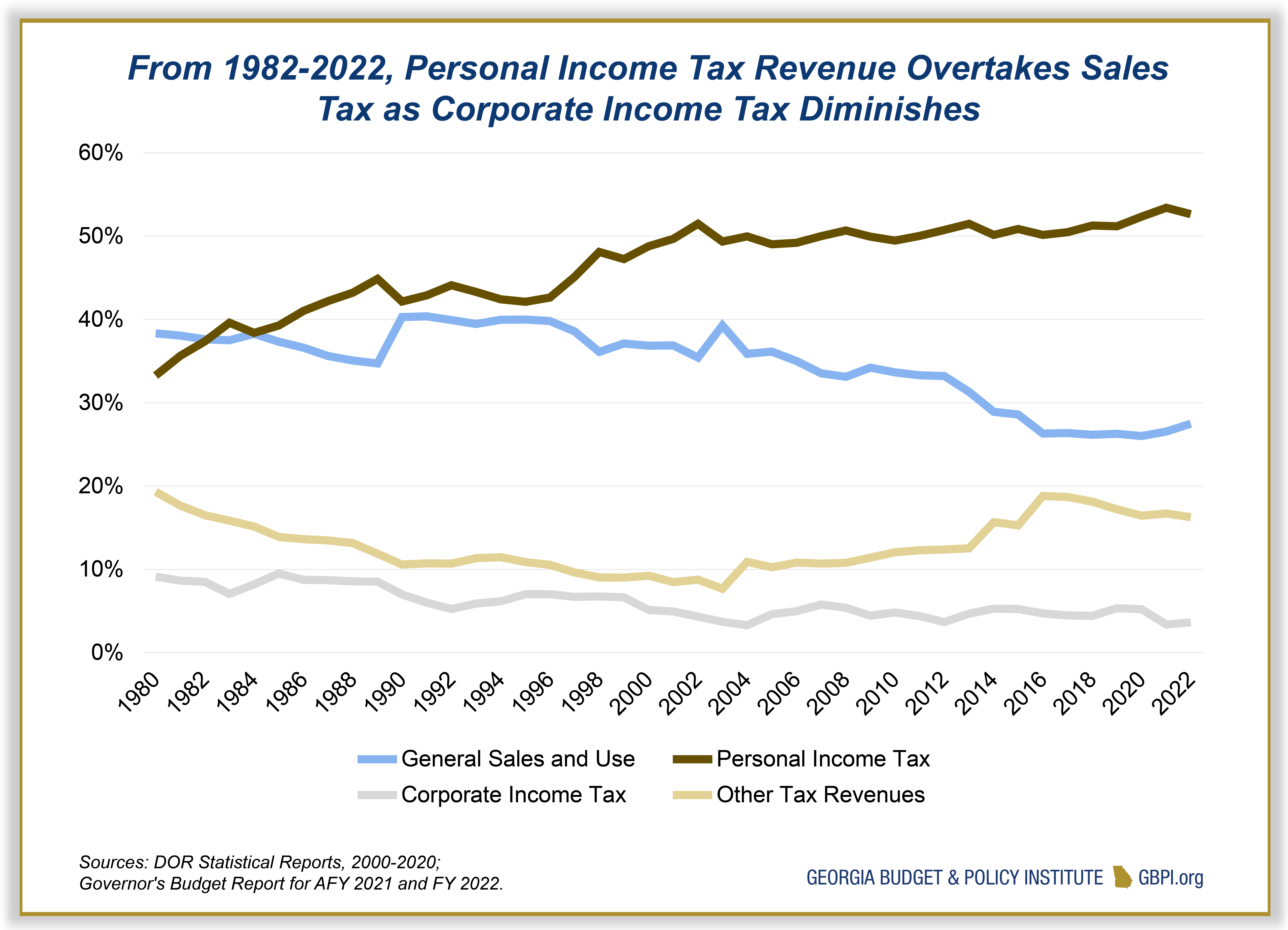

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Georgia State Taxes 2020 2021 Income And Sales Tax Rates Bankrate

Fulton County Sends Out Annual Assessment Notices To Milton Homeowners News Milton Ga

Property Taxes Laurens County Ga

Georgia Taxes Georgia Income Tax Georgia Tax Rates Georgia Economy Georgia Business For Enterpenures 2021

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

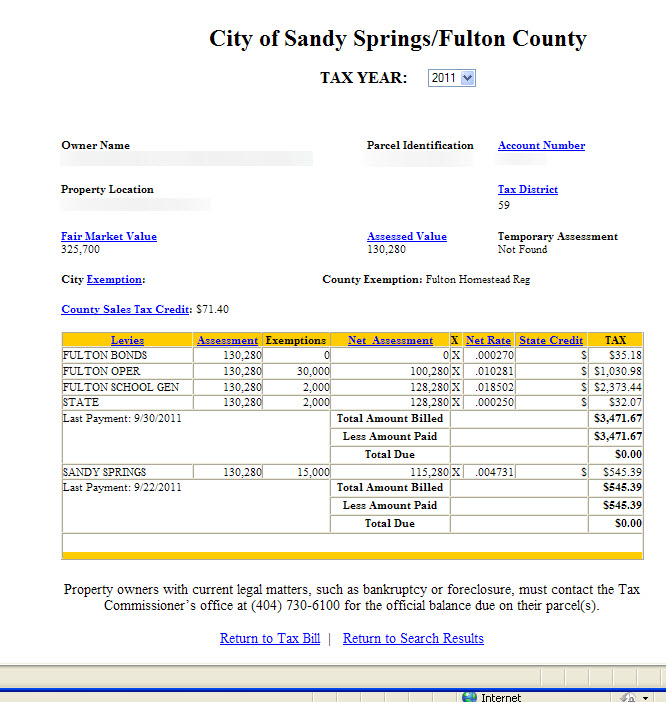

Sandy Springs Georgia Property Tax Calculator Millage Rate Homestead Exemptions

North Central Illinois Economic Development Corporation Property Taxes

Georgia Revenue Primer For State Fiscal Year 2022 Georgia Budget And Policy Institute

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

2021 Property Tax Bills Sent Out Cobb County Georgia

Property Overview Cobb Tax Cobb County Tax Commissioner

2021 Property Tax Bills Sent Out Cobb County Georgia

Atlanta Georgia Property Tax Calculator Fulton County Millage Rate Homestead Exemptions

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Tax Rates Gordon County Government

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute